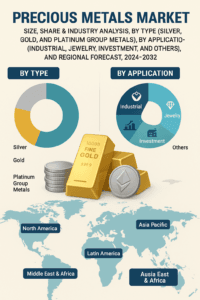

Precious Metals Market Size, Segments, and Growth Opportunities to 2032

According to Fortune Business Insights, The global precious metals market size was USD 306.44 billion in 2023 and is projected to grow from USD 323.71 billion in 2024 to USD 501.09 billion by 2032 at a CAGR of 5.6% during the forecast period. Asia Pacific dominated the precious metals market with a market share of 52.33% in 2023.

The global precious metals market is experiencing robust growth, driven by increased demand from both traditional and emerging sectors. Precious metals such as gold, silver, platinum, and palladium have long been valued for their rarity, economic significance, and intrinsic value. Today, they continue to play a vital role in industries ranging from jewelry and electronics to automotive and renewable energy technologies. Increasing disposable incomes and changing lifestyle choices are a few of the factors driving the market. The demand for these metals is estimated to propel globally for jewelry and investment applications as gold and silver are of prime importance in wedding ceremonies of Southeast Asian countries.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/precious-metals-market-105747

LIST OF KEY COMPANIES PROFILED:

- Newmont Corporation (U.S.)

- Barrick Gold Corporation (Canada)

- AngloGold Ashanti Limited (South Africa)

- Kinross Gold Corporation (Canada)

- Newcrest Mining Limited (Australia)

- Gold Fields Limited (South Africa)

- Freeport-McMoRan (U.S.)

- Wheaton Precious Metals (Canada)

Market Overview

The precious metals market is fundamentally influenced by a balance of investment sentiment, industrial consumption, and macroeconomic trends. As of recent years, growing geopolitical tensions, currency volatility, and inflation concerns have led investors to seek refuge in precious metals, particularly gold and silver. Simultaneously, industrial demand—especially for silver and platinum—has surged due to advancements in electronics, solar power, and clean energy technologies.

Key Precious Metals and Their Applications

-

Gold: Often seen as a safe-haven asset, gold continues to dominate the investment landscape. It is also widely used in jewelry, accounting for a significant portion of global demand. Additionally, its use in electronics and medical devices is expanding.

-

Silver: Known for its excellent conductivity, silver is crucial in electronics, solar panels, batteries, and medical applications. Demand for silver has grown considerably with the increasing deployment of photovoltaic (PV) systems worldwide.

-

Platinum: This metal is extensively used in automotive catalytic converters, as well as in the chemical, petroleum, and medical industries. Platinum is also a key element in hydrogen fuel cell technology, which is gaining momentum in the clean energy sector.

-

Palladium: Like platinum, palladium is primarily used in emission control devices in vehicles. The tightening of environmental regulations globally has significantly boosted demand for palladium.

Market Drivers

1. Rising Industrial Applications

One of the primary drivers of the precious metals market is the increasing range of industrial applications. The shift towards electric vehicles (EVs), stricter emissions regulations, and growth in renewable energy have created substantial demand for metals like silver, platinum, and palladium. For example, silver is indispensable in the production of solar panels, while platinum and palladium are essential in catalytic converters and hydrogen fuel cells.

2. Growing Investment Demand

Gold and silver have historically been used as hedges against inflation and currency fluctuations. With ongoing geopolitical tensions, economic uncertainty, and fluctuating fiat currency values, investment in precious metals through ETFs, bullion, and coins has increased. Central banks in many countries are also diversifying their reserves by adding more gold.

3. Jewelry Market Growth

The demand for precious metals in the jewelry sector remains strong, especially in emerging markets such as India and China. These countries account for a significant share of global gold consumption, driven by cultural traditions and increasing disposable income. Platinum and silver are also gaining popularity in modern jewelry design.

Regional Insights

-

Asia-Pacific: The region dominates the global precious metals market due to high demand in India and China. In addition to strong jewelry demand, industrial use is also expanding, particularly in China’s rapidly growing electronics and renewable energy sectors.

-

North America: The U.S. is a major market for investment in precious metals, especially gold and silver. The region also houses significant reserves and mining operations.

-

Europe: Demand in Europe is driven by environmental regulations and green energy initiatives. European automakers are increasingly turning to platinum and palladium for emission-reducing technologies.

-

Latin America and Africa: These regions are rich in mineral resources and play a critical role in the global supply chain. Countries like South Africa and Peru are key exporters of platinum, gold, and silver.

Challenges in the Market

Despite strong growth prospects, the precious metals market faces several challenges:

-

Price Volatility: Precious metals prices can be highly volatile due to speculation, interest rate changes, and geopolitical events.

-

Environmental Concerns: Mining operations often raise environmental and social concerns, which can affect project approvals and timelines.

-

Supply Chain Disruptions: Geopolitical tensions and logistical constraints can disrupt the supply of precious metals, impacting prices and availability.

Information Source: https://www.fortunebusinessinsights.com/precious-metals-market-105747

Future Outlook

The future of the precious metals market looks promising, with several trends expected to shape its trajectory:

Green Energy and Electrification: As the world transitions to cleaner energy, demand for silver, platinum, and palladium will rise due to their roles in solar panels, fuel cells, and electric vehicles.

Technological Integration: Advancements in electronics, 5G technology, and medical devices will further boost industrial demand for silver and gold.

Sustainable Mining Practices: Companies are increasingly investing in green mining technologies and circular economy initiatives to reduce their environmental footprint and ensure long-term viability.

Digital Transformation: The use of blockchain in precious metals trading and the rise of digital gold platforms are improving transparency, accessibility, and investor confidence.

The precious metals market is evolving rapidly, influenced by a mix of traditional drivers and new-age technologies. Whether as investment instruments, industrial components, or cultural artifacts, precious metals will continue to hold their intrinsic value and strategic importance. With growing interest from both consumers and industries, the market is set to expand in the coming years—making it a compelling area for investment, innovation, and policy focus.